Eleven PM, Saturday. I should be going to bed. Feeling hot and sweaty. Just clicked a link to a blog post Vic sent me. This one is by the Atlantic’s Meg McCardle.

Meg predicts that we are in for a series of new financial shocks this time in the commercial real estate world. A quarter trillion of possible defaults could take place each year for the next couple of years. It may not be the end of the world but its not got to be good.

This passage comes near the end of her post:

The best explanation for the calamity that has overtaken us may simply be that cheap money makes us all stupid. The massive inflows of international capital, which Ben Bernanke has called the “global savings glut,” poured into our loan markets, driving interest rates lower and, since most real estate is purchased with borrowed funds, pushing up the price of property in both the commercial and residential sectors. Rising prices, in turn, disguised any potential problems with the borrowers, because if they ran into cash-flow problems, they could always refinance, or sell. Everyone was getting bad signals from the market, and outlandish purchases looked almost rational.

That answer isn’t quite satisfying, especially in the face of another financial meltdown. We don’t want ambiguity and complex systems; we want heroes, villains, and a happy ending. But by now we should all know that real-estate markets are rarely the stuff of fairy tales.

Read the whole thing but if you are not an economist or a commercial landlord you may have a hard time following it.

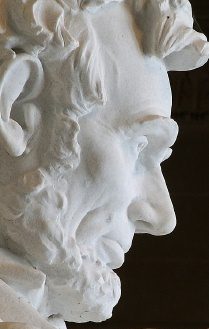

So having read it I’m all hot and sweaty. Why? Well, I wanted to be something of a political sage, like Gregory Peck in To Kill a Mocking Bird. I might be trapped in insane times but I’d personally stand up to the foolishness and do what was right. Well, I’ve not been very successful at that.

This notion of easy “cheap” money is much on my mind. Early on in my fight against the denial of a referendum on the Red Plan I ran across a UM Law Professor who was telling me about a book he’d been reading. The upshot was that bankers loved to have government borrow money because government in the US never goes bankrupt. All the state constitutions with the exception of one require that state’s never go into default. In Minnesota’s case ( and probably most other state’s cases) subdivisions like Cities that get into financial trouble can tell banks and bond companies to have the state pay up should they go into default.

Under these circumstances what banker wouldn’t lend government more than it could easily handle? And so Duluth’s school board got the biggest single school construction project in state history. It won’t save money on energy. It will cost double what the District told voters. The banks will be paid back by the taxpayers because that’s how it works. Easy money and everybody who is part of the project can hide behind school children and say Its for our city’s future.

I’ve been fighting two battles over the past three years having to do with the foolishness easy money provokes. The Red Plan is the first and its taken up three quarters of my energy. The other has been very personal and I’ve only alluded to it occasionally in the most veiled way.

My Mother was placed in a full time Alzheimer’s facility nearly five years ago. A family member then put two mortgages on my Mother’s home which were inflated by the prices of the housing boom that was nearing its peak back then using the Power of Attorney over my Mother. When my brother and I were asked to OK the transfer of nearly a hundred grand from our Mother’s savings we balked and began asking questions. We knew nothing about the size of the mortgages placed on our Mother’s house.

We’ve been in court for much of the past two years trying to save the last third of our Mother’s estate. We were awarded the power of attorney and proceeded with a short sale of our Mother’s home. We discovered how disfunctional the banks that handed out too much easy money (credit really) have become.

After a year’s struggle where my brother each spent close to forty hours on the phone listening to elevator music waaiting for someone to answer our calls we succeeded in getting both banks to eat about $120,000 of their mortgage money. They didn’t want to give it up so its not surprising that they were hard to get hold of. The bank loss is considered my mother’s gain even though she never saw a dime of the original loans. Now she has to add a phantom $120,000 to last year’s income and pay taxes on it.

Damn Washington Mutual still hasn’t sent me the 1099 showing my Mother’s “earnings” so I can do her taxes. It should have been sent out on Jan 31st of course. I’m not eager to have my Mother pay more taxes but I’ve already had to redo the past three years worth of my Mother’s income taxes. Each year we discovered more taxes needed to be paid along with penalties. I don’t plan to play games with the IRS.

Greed and vanity seem to have fueled both of these calamities that have consumed so much of my time. Ironically both of them interrupted my plans to write a history about the biggest Minnesota political scandal in the last century. It involved cheap money too – taxpayer’s money.

I’ve got a GD hopeless goody-two-shoes gene in my DNA. It was handed down to me from both sides of my family.

My Mother’s father was a war hero. Like many war heroes he was given a leg up in a political career. He was appointed the State Auditor of Kansas when his predecessor who had just been caught in a huge scandal died in office a political disgrace. I’ve been told a number of stories about my Grandfather’s high ideals and my Mother told me that her Father always said that once a man has lost his reputation he’s lost everything. I could debate that point but this conviction help explain why he was always elected every two years like clockwork. voters want the people handling their taxes to be squeaky clean.

My Father was the same. As a kid growing up next to the corrupt Pendergast machine that ran Kansas City he was a great champion of clean government. When he was in high school he drew up lists of candidates for his parents to vote for. When he became a state investigator for the Kansas State Insurance Commissioner he made the mistake of advising his boss to stop accepting generous gifts from the Insurance Companies they regulated. The following year we moved to Minnesota.

I’ve drawn a little criticism because I can’t configure this blog to accept responses to my posts. As I’ve explained before when I did this at first I discovered that I was getting hundreds of spam responses. And yet my critics have always been free to email me.

I keep mentioning Vic. He emails me all the time and keeps me honest or at least he requires that I justify myself when he thinks I’m getting too high and mighty. Generally these debates cast me as the liberal against Vic defending the Republican side. Vic’s not a Republican. He has a couple views that would get him drummed out of the party instantly and frankly he hates political parties. He’s thinks most politician’s are vacuous mouth pieces. If anything he’s more of a Libertarian although he told me recently that he has some serious disagreements with the best known libertarian or our era, Ron Paul.

So, having kept (or never deleted) a number of our email debates I may look for some oldies but goodies and post a few of them to give a flavor how I handle argument. I never got to exercise this much beyond the Duluth School Board because the Republican Party required me to be one of those damned mouth pieces and I couldn’t do it. Republicans know a thing or two about cheap money. Its cheap for them because they spend it and expect their children to pay off their debts.

My Republican Father and my Republican Grandfather would have been aghast. I hope when I meet them in the next world they will both forgive me for caucusing with Democrats over the past two election cycles. Its been a little like wearing a hair shirt.